The Evergreen Difference

There’s no longer two choices.

We take the fiduciary model a step further with our flat fee pricing regardless of account sizes. Our goal is to provide a small number of clients a great alternative to the two main alternatives elsewhere: Work with a small firm that provides attention and pay a 1% management fee or be one of several hundred clients at a large, low-cost firm that has incentives to steer you in more profitable areas of their business.

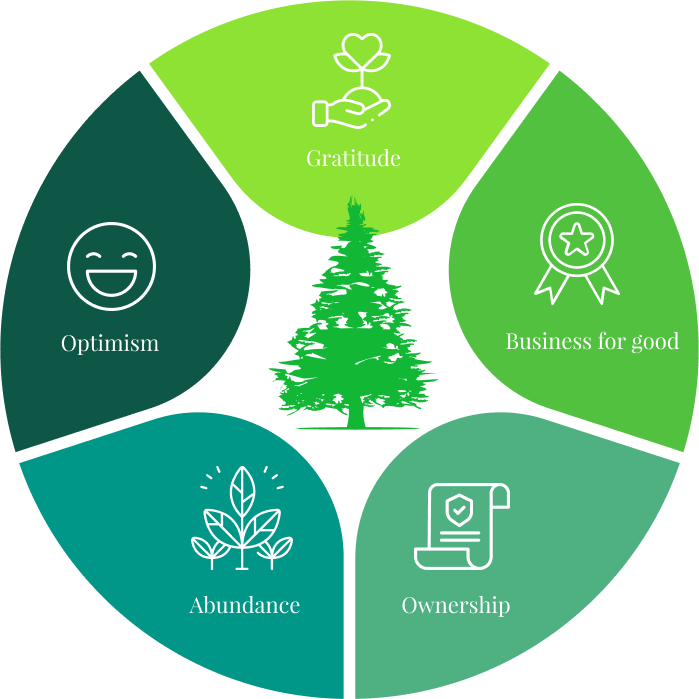

Discover our values and how they impact you

Understand our difference

A set fee structure

- You keep more of the profits as your money grows

- You know you are equally as important to our firm than any other client

- We don’t use your account balances to determine your fee

- Eliminates our incentive to constantly "sell" clients on the idea to move all of their assets to our firm

Add-on products are not necessary

- The only source of revenue for our firm is our flat fee.

- We do not sell life insurance, annuities, nor do we collect any referral fees to attorneys or CPAs.

- We are a fiduciary and legally bound to act in your best interest.

Advisor for life

Have you had several advisor changes forced upon you from your investment firm?

Evergreen was founded because Nick wanted to provide fiduciary investment advice for a small amount of clients for the long haul. The strategy is to stay small, be nimble, seek to understand our clients' needs first and become your advisor for a lifetime.

How Do We Compare?

- Flat fee pricing

- We don't sell add on products like insurance or annuities that result in conflicts of interest

- Our approach is passive investment management which allows the markets to drive realistic returns

- Our goal is to say intentionally small so we can focus intently on you

- Every client is equally important to us. Your portfolio size does not determine the level of service you will receive

Other financial advisors

- Your price is based on the percentage of your assets. The more you have, the more you pay.

- They can sometimes turn your financial plan into an opportunity to offer you options that can raise the question of it being in your best interest or theirs

- They can tend to prioritize their bottom line before clients and the communities best interest

- Costly active management with promises of outsized returns

- Focused more on new prospects than on existing clients

- Clients with larger accounts are more of a priority as they drive more revenue than smaller accounts

Ready to discuss your plans?

If you feel we could be a fit for you and your family's plan, we

suggest setting up an introductory meeting. We can explore your concerns, questions and so much more, together.