About

There’s no longer two choices.

We take the fiduciary model a step further with our flat fee pricing regardless of account sizes. Our goal is to provide a small number of clients a great alternative to the two main alternatives elsewhere: Work with a small firm that provides attention and pay a 1% management fee or be one of several hundred clients at a large, low-cost firm that has incentives to steer you in more profitable areas of their business.

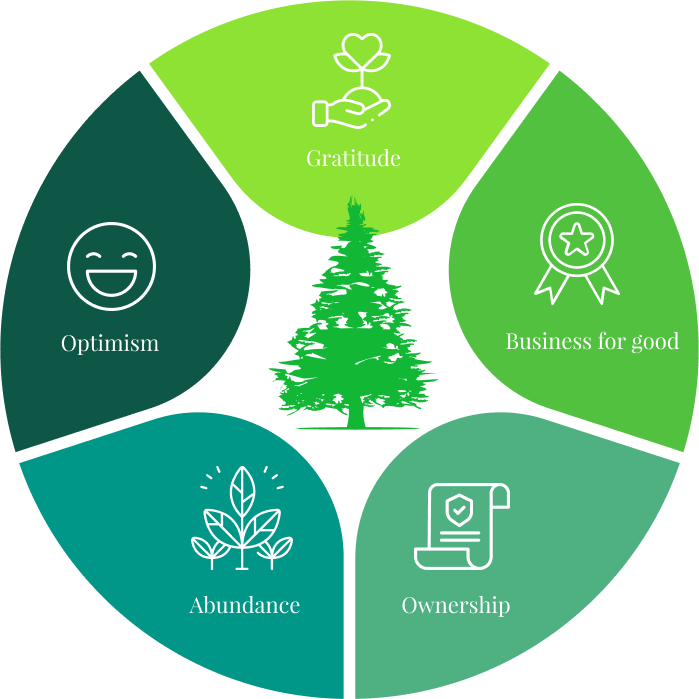

Discover our values and how they impact you

Often misunderstood as unrealistic. To us, a positive mindset is looking forward to the path of possibility while brutally acknowledging and acceptancing the current situation.

Appreciating what we have while still striving for more. Gratitude provides us clarity during the inevitable difficult times which allows us to make good decisions.

Businesses have a tremendous responsibility in their communities. We take that very seriously and seek to leave our community better than we found it.

When we take ownership, we control our own destiny. This mindset helps us focus on our own plans and save energy to work with you on things that matter.

This creates a positive, circular energy of rooting for others with a deep understanding that there are plenty of opportunities. In other words, we want everyone to succeed.

Understand our difference

A flat fee structure

Ad-on products are not necessary

Advisor for life

A set fee structure

- You keep more of the profits as your money grows

- You know you are equally as important to our firm than any other client

- We don’t use your account balances to determine your fee

- Eliminates our incentive to constantly "sell" clients on the idea to move all of their assets to our firm

A set fee structure

- You keep more of the profits as your money grows

- You know you are equally as important to our firm than any other client

- We don’t use your account balances to determine your fee

- Eliminates our incentive to constantly "sell" clients on the idea to move all of their assets to our firm

A set fee structure

- You keep more of the profits as your money grows

- You know you are equally as important to our firm than any other client

- We don’t use your account balances to determine your fee

- Eliminates our incentive to constantly "sell" clients on the idea to move all of their assets to our firm

How Do We Compare?

- Flat fee pricing

- We don't sell add on products like insurance or annuities that result in conflicts of interest

- We stand by our values and have pledged since founding the firm to donate 5% of profits to local charities

- Our approach is passive investment management which allows the markets to drive realistic returns

- Our goal is to say intentionally small so we can focus intently on you

- Every client is equally important to us. Your portfolio size does not determine the level of service you will receive

Other financial advisors

- Your price is based on the percentage of your assets. The more you have, the more you pay.

- They can sometimes turn your financial plan into an opportunity to offer you options that can raise the question of it being in your best interest or theirs

- They can tend to prioritize their bottom line before clients and the communities best interest

- Costly active management with promises of outsized returns

- Focused more on new prospects than on existing clients

- Clients with larger accounts are more of a priority as they drive more revenue than smaller accounts

Ready to discuss your plans?

If you feel we could be a fit for you and your family's plan, we

suggest setting up an introductory meeting. We can explore your

concerns, questions and so much more, together.