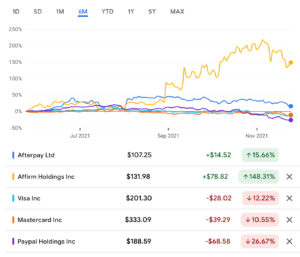

The buy now pay later (BNPL) options seem to be popping up everywhere on ecommerce sites as a way to spread out a purchase into organized, simplified installments that are often interest free. Companies like Afterpay, Klarna, and Affirm offer these services and catching some attention from the big players like Visa, Mastercard, and Paypal. The stocks themselves have been catching a lot of attention from investors. Affirm up almost 150% in the last 6 months and Afterpay up over 15% while all the traditional players down during the time period. Paypal does own Venmo which has seen tremendous growth making it easy to make payments between individuals with no fee. They’re now expanding that as a payment option with many big retailers.

Many are considering this innovation a revolution within the credit industry. Customers are enjoying the simplicity and convenience. Once clicking on the BNPL provider at the point of purchase it provides options for payments over 4 weeks or 6 weeks, often at zero interest and providing terms further out in time with interest charges. The consumer will pay a small amount up front and the providers lay out in very clear terms what the options are for installment payments of the balance. All of this with no credit check.

Taking a step back, credit cards do have quite the stigma of being complicated with interest calculations being misleading and encouragement of consumers to overspend. Everyone has a different relationship with money but almost all of us have a friend or family member that got in trouble with credit cards and many millennials are extremely hesitant to use them, preferring debit cards to avoid that trap. Credit cards have always pointed consumers towards the minimum payment which causes interest to accrue so there is a lack of trust there, myself included. I remember my first business course in college when the professor laid out an example of a $1,000 television purchase. He walked us through the math of how much that TV would cost if the college grad only made the minimum monthly payments, and years later by the time the TV was actually paid for it cost 2-3 times more than the original purchase due to all of the interest charges.

I have been skeptical of the BNPL craze as these companies are just packaging credit in a different way. Consumers can use a credit card and (depending on timing of statement cycles and when payments are made) pay zero interest if the balance is paid off within 4-6 weeks. If balances are not paid off within that timeframe interest begins to accrue which is very similar to the timeframes allowed by these BNPL firms. Some of them stop allowing you to use their service until past debts are paid.

Most of the BNPL companies don’t report on time payments to the credit bureaus while reporting when people are late on payments. This doesn’t give consumers the credit boost during the on-time payments, while penalizing them when missing payments. Perhaps this is a tradeoff for not needing any credit check when making purchases.

The BNPL marketing seems to be demonizing the credit card companies with their egregious interest rates, but BNPL seems to be very similar if not worse. Both Klarna and Afterpay have terms that say they won’t charge more than 25% of purchase price in fees. 25% interest over a 4-week timeframe equates to 300% annual interest rate. These interest charges kick in if payments are missed and vary from the different providers. They also use some type of internal algorithm that determines how much credit they will grant customers based on new or existing customers, on-time payment history, and likely hundreds of other data points that we don’t even know about.

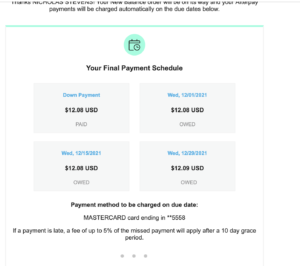

After writing this post I was curious and figured I’d give them a try and I used Afterpay when purchasing some joggers and then a pair of jeans. I actually bought two different sizes of jeans and will return one of them so we’ll see how the return gets refunded and impacts my payments. Here’s a summary page from the first purchase:

It was very easy to use just clicking the Afterpay radio button and place order. It then brought me to Afterpay side of things and prompted me to login or create an account which I did. I used my credit card as my payment to Afterpay so I essentially have spread out and delayed the payment even further. Perhaps 1 or 2 of the installments will hit my next credit card cycle and the other 2 payments going into the next cycle so that is a potential benefit to any of those out there really trying to stretch out their payments as long as possible with zero interest.

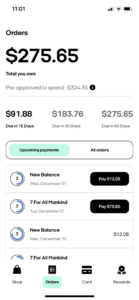

For those who use their debit cards as the payment source, if these BNPL platforms make credit easier to understand for consumers looking to dip their toe into responsible use of credit then that is certainly a good thing. To me that’s my main takeaway. Take a look at how the app looks summarizing my two purchases.

When looking at any business I always try to ask myself “what problem are they solving?”. They’re not solving the problem of credit card companies are greedy and charge a lot of interest, we’re nice and on your side. They’re not solving the problem of how can I spend more than I earn? They’re making credit as simple as it should be. They’re making credit easy to understand. They help consumers visualize what their cash flow looks like for the next 15 days, 30 days, 45 days empowering them to better make purchase and saving decisions. I know my credit card statement shows me a minimum payment number, payments, credits, new balance, previous balance, interest charged, fees charged, due date. A lot of data in an unorganized, unfriendly way. With all of the technology and user-friendly apps we have become accustomed to, we all now demand that everything we interact with is easy to use and on our terms. These companies understand that and their customer much better than the traditional providers. Going into this post I thought it was going to be a theme of “Overrated, nothing to see here, same thing, different packaging” and it technically is. However, the experience is not the same at all and that’s what matters. I don’t think I’ll be a big user but I certainly see the value of the services. The BNPL providers seem to have little to no rewards programs which is something I would miss. I’m sure that will evolve over time but for now that is a point for the big guys.

They’re having an impact on the industry and likely will cause a lot of the big providers to rethink services, making them easier to use and maybe even fun to use, what a concept!

Information was obtained from third-party sources, which we believe to be reliable but not guaranteed for accuracy or completeness. The information provided does not take into account the specific objectives, financial situation or particular needs of any specific person.The information provided should not be relied upon as investment advice or recommendations, does not constitute a solicitation to buy or sell securities and should not be considered specific legal, investment or tax advice. Investing entails risk, including the possible loss of principal, and there is no assurance that the investment will provide positive performance over any period of time.